Important tax info for 2025

Casualty Loss: Effective beginning in 2018, this deduction has been eliminated, with the exception of casualty losses suffered in a federal disaster area. A taxpayer who suffers a personal casualty loss from a disaster declared by the President under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act will still be able to claim a personal casualty loss as an itemized deduction, subject to the $100-per-casualty and 10%-of-Adjusted Gross Income limitations.

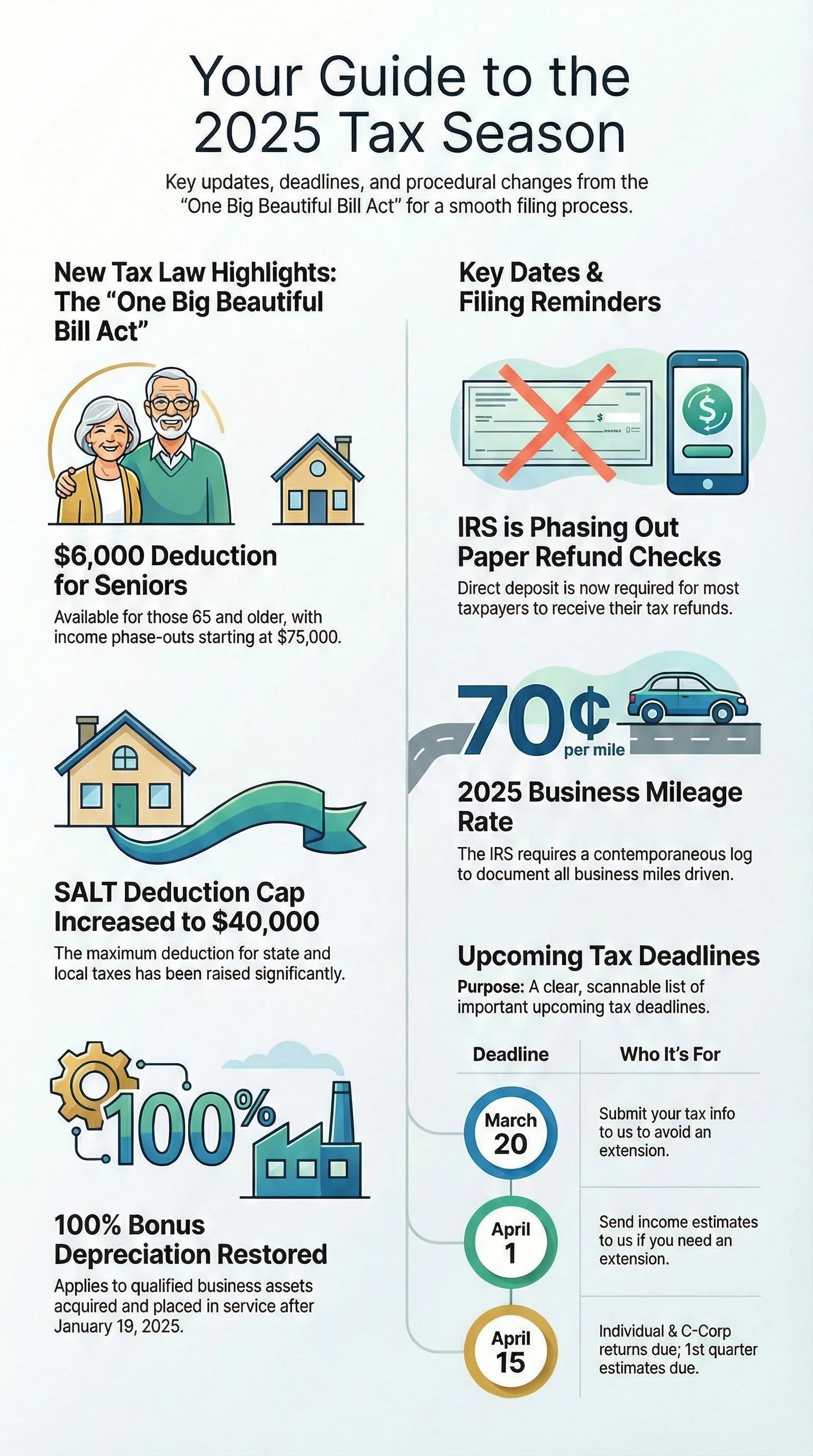

Extra $6,000 Deduction For Seniors: Taxpayers 65 years of age or older may be able to claim an additional deduction of $6,000 on top of their standard or itemized deductions, effective for tax years 2025 through 2028. The deduction phases out for higher income starting at $75,000 for single filers and $150,000 for married filers.

Deduction for Tips: Effective for the 2025 tax year, employees and self-employed individuals may deduct qualified tips they received in occupations the IRS identified as “customarily and regularly receiving tips”. The maximum annual deduction is $25,000.

Deduction for Overtime: For the 2025 tax year, individuals may deduct the portion of qualified overtime pay that exceeds their regular rate of pay. The maximum annual deduction is $12,500 ($25,000 for joint filers).

Deduction for Car Loan Interest: Deduction of up to $10,000 for interest on car loans taken out after 2024 for the purchase of a new personal use vehicle assembled in the U.S. The deduction phases out for adjusted gross income above $100,000 ($200,000 for joint filers). To find out if your vehicle was assembled in the U.S., go to: vpic.nhtsa.dot.gov/decoder/ and put in the vehicle's VIN and model year. The last item under "Other Information" is the final assembly plant's location.

Child Tax Credit: For the 2025 tax year, the child tax credit is $2,200 per qualifying child under age 17. The credit amount decreases if your modified adjusted gross income exceeds $400,000 (married filing jointly) or $200,000 (all other filers). The credit is nonrefundable, but some taxpayers may be eligible for a partial refund of this amount up to $1,700 through the additional child tax credit.

Qualified Business Income Deduction: This provision, also known as Section 199A, allows a deduction of up to 20% of qualified business income for owners of some businesses during the year 2025. Limits apply based on income and type of business. The K-1’s from S Corporations and Partnerships will possibly be much more detailed due to allocations of business income in some cases.

Business Interest Expense Deduction: In general, for businesses with $31 million or less in average annual gross receipts, business interest expense is limited to business interest income plus up to 30% of the business’s adjusted taxable income for the 2025 tax year. For taxable years beginning in 2025 and beyond, the One Big Beautiful Bill Act (OBBBA calls for adjusted taxable income to be computed before any deductions for depreciation, amortization, or depletion.

Like-Kind Exchanges: Like-kind exchange treatment applies only to certain exchanges of real property for the 2025 tax year.

Meals: Deductions for meals is 50% for the 2025 tax year. The taxpayer or an employee must be present and the food or beverages should not be considered as lavish or extravagant. If food is provided during or at an entertainment activity, the food and beverages must be stated separately from the cost of the entertainment.

Entertainment: Deductions for expenses related to entertainment activities are not deductible for the 2025 tax year.

Medical Expense Deduction: In 2025, your out-of-pocket medical expenses will need to exceed 7.5% of your AGI before any of those expenses can become eligible for itemized deductions.

Home Mortgage Interest: You may only be able to deduct interest on acquisition indebtedness, which is your mortgage used to buy, build or improve your home up to $750,000 ($375,000 for married taxpayers filing separately).

Taxes: If you itemize your deductions in 2025, you may be allowed a deduction for general sales tax, property taxes, and State income tax with an overall limit of $40,000 ($20,000 for married taxpayers filing separately).

Charitable Donations: For 2025, taxpayers who itemize deductions on their tax returns can make a donation to a qualifying charity and deduct up to 60% of their adjusted gross income.

Premium Tax Credit for Individuals: You may be eligible if you meet all of the following: Buy health care through the marketplace, are ineligible for coverage through an employer or government plan, do not file married filing separate returns (unless domestic abuse victims), and cannot be claimed as a dependent by another person. Visit: https://www.irs.gov/affordable-care-act.

Depreciation: 40% Depreciation expensing for certain business property acquired and placed in service prior to January 20, 2025, is available. The new law permanently restores 100% first-year depreciation for eligible assets acquired and placed in service after January 19, 2025.

Section 179 Deduction Limit: The small business expensing limitation and phase-out amounts from prior years have been extended for 2025. Businesses can expense up to $2,500,000 in 2025. The phase-out is $4,000,000.

A 0.9% Medicare surtax on earned income for higher-incomers: This applies to wages as well as to self-employment income. Singles and heads of household will owe it once total earnings exceed $200,000; married filing jointly - over $250,000; married filing separately – over $125,000. It applies only to the employee’s share of Medicare tax.

The 3.8% Medicare surtax on net investment income: This applies to unearned income of single filers and heads of household who have modified adjusted gross incomes above $200,000, couples with modified AGIs over $250,000 and $125,000 for separate filers.

Capital gains and dividends have a top rate of 20% for high income taxpayers – singles over $533,400 and married couples over $600,050. For others, it may be 15% or less in some cases. (Also see 3.8% Medicare tax.)

The estate and gift tax exemption for 2025 increases to $13,990,000: The tax rate remains at 40%. The annual gift, exempt from filing requirements, increased to $19,000 per donee. Gift tax returns are due by 4/15/26 if gifting over $19,000 per person.

Personal tax rate: This rate remains at 37%. for the 2025 taxable income over $626,350 for singles; $626,350 for head of household; $751,600 for married couples filing jointly.

The 2025 standard deduction rises to $31,500 for married. If one spouse is 65 or older -- $33,100 if both, then $34,700 Singles -- $15,750; $17,750 if they are 65. Heads of household -- $23,625; $25,625 if they are 65. The additional standard deduction amounts for taxpayers who are blind are $1,600 each for married, and $2,000 for Single or Head of Household.

Have Questions? Schedule a consultation today at (863) 676-7981.